Real Estate Cash Flow Investments in New York City: Your Guide to Generating Passive Earnings

Real estate capital investments have actually long been a reputable means to build riches and create passive revenue. In a vibrant market fresh York, opportunities are plentiful for savvy investors to protect homes that create regular capital. From dynamic metropolitan facilities to suv hideaways, New york city supplies diverse real estate alternatives to suit various financial investment strategies. Right here's your overview to understanding and making the most of property capital financial investments in New york city.

What Are Property Capital Investments?

Capital investments in realty describe buildings that generate earnings surpassing the expenses of ownership, such as mortgage repayments, maintenance, taxes, and insurance. Favorable capital offers a constant earnings stream, making it an attractive method for lasting wealth building.

In New York, capital buildings can range from multi-family homes and single-family services to industrial residential or commercial properties and trip rentals. The secret is identifying places and building types that straighten with your financial objectives.

Why Invest in New York Realty for Capital?

High Rental Need

New york city's diverse population and vivid economy make certain consistent demand for rental homes. Urban facilities fresh York City, suburbs in Long Island, and scenic upstate locations bring in a large range of lessees, from experts to students and vacationers.

Solid Market Appreciation

While cash flow is the main focus, New York residential or commercial properties frequently gain from lasting gratitude, adding another layer of earnings to your financial investment.

Diverse Financial Investment Opportunities

New York uses buildings throughout a large range, including deluxe apartments, multi-family units, and industrial spaces, permitting investors to tailor their techniques based on their experience and spending plan.

Tourism and Seasonal Rentals

Places like the Hudson Valley and the Adirondacks grow on tourism, making short-term and mid-term rental financial investments highly financially rewarding.

Top Locations for Capital Investments in New York City

New York City

The 5 boroughs-- Manhattan, Brooklyn, Queens, Bronx, and Staten Island-- offer limitless opportunities for capital financial investments. Multi-family homes and mixed-use residential properties in external boroughs are especially appealing for regular rental earnings.

Long Island

Rural Long Island provides chances for single-family rentals and villa, particularly in areas like the Hamptons and North Fork.

Upstate New York

Regions like Albany, Saratoga Springs, and Buffalo have actually seen growing need for economical housing, making them excellent areas for money flow-focused investments.

Hudson Valley

A hotspot for vacation rentals, the Hudson Valley brings in vacationers and long-term renters alike. Properties below provide a mix of affordability and high returns.

Western New York City

Cities like Rochester and Syracuse are recognized for their price and strong rental need, making them suitable for capitalists seeking homes with lower acquisition costs and higher yields.

Types of Capital Financial Investment Characteristics

Multi-Family Houses

Multi-family properties, such as duplexes and apartment buildings, are amongst the most effective for regular capital. The numerous devices supply diversified income streams, minimizing threat.

Single-Family Rentals

Single-family homes supply stability and are easier to take care of. These are preferred in country markets like Long Island and parts of upstate New York.

Trip Services

High-tourism locations https://sites.google.com/view/real-estate-develop-investment/ like the Adirondacks or the Hamptons can produce significant revenue with temporary rental platforms like Airbnb.

Industrial Features

Retail areas, office complex, and mixed-use properties in metropolitan locations can give https://sites.google.com/view/real-estate-develop-investment/ high returns, especially in busy business districts.

Steps to Prosper in Property Cash Flow Investments

Evaluate Prospective Capital

Compute your residential or commercial property's anticipated earnings and subtract all costs. This includes funding settlements, tax obligations, insurance policy, upkeep, and building administration costs. Favorable capital is your goal.

Pick the Right Place

Research study rental demand, vacancy prices, and typical rental income in your chosen location. Choose locations with solid economic development and tenant need.

Safe and secure Funding

Look for funding options that straighten with your financial investment goals. Low-interest loans or collaborations can maximize your roi (ROI).

Partner with Residential Or Commercial Property Management Provider

Expert residential or commercial property monitoring business can manage lessee connections, upkeep, and rent collection, guaranteeing a smooth financial investment experience.

Leverage Tax Benefits

Realty financial investments supply tax benefits, such as depreciation and deductions for maintenance expenses, lowering your gross income.

Typical Challenges and Exactly How to Get rid of Them

High First Prices

New york city real estate is known for its high residential property worths, specifically in city locations. Consider starting with smaller homes or purchasing emerging markets upstate.

Tenant Turn over

High occupant turn over can minimize cash flow. Display lessees extensively and supply motivations for long-term leases to minimize this danger.

Regulative Challenges

New York has strict rental regulations and guidelines. Acquaint yourself with neighborhood regulations or employ an knowledgeable real estate lawyer to browse these complexities.

The Future of Property Capital Investments in New York

The demand for rental homes in New york city continues to be strong, sustained by economic development, populace diversity, and tourist. Urban areas fresh York City continue to see high need, while upstate regions supply budget friendly entrance points and appealing yields.

As remote work fads grow, rural and backwoods are seeing an influx of tenants, opening up new possibilities for investors. Furthermore, sustainability-focused developments and modernized buildings are attracting higher rental fees, making them rewarding investments.

Property capital financial investments in New York provide a reliable method to develop wide range and attain financial freedom. By picking the right area, residential or commercial property type, and management method, you can produce a constant earnings stream and take pleasure in long-lasting recognition.

Whether you're a experienced financier or just starting, New York's diverse market offers opportunities to suit your goals. With mindful preparation and market evaluation, you can turn your realty investments right into a growing resource of passive income.

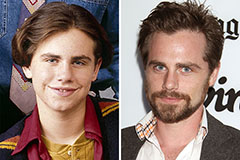

Rider Strong Then & Now!

Rider Strong Then & Now! Romeo Miller Then & Now!

Romeo Miller Then & Now! Michael C. Maronna Then & Now!

Michael C. Maronna Then & Now! Danica McKellar Then & Now!

Danica McKellar Then & Now! Macaulay Culkin Then & Now!

Macaulay Culkin Then & Now!